tax on unrealized gains uk

Short-term capital gains are taxed at your ordinary tax rate. Unrealized income or losses are recorded in an account called accumulated other comprehensive income which is found in the owners equity section of the balance sheet.

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

3 percent only for the PIT taxpayers if the tax value of an.

. In 2021 to 2022 the trust has gains of 7000 and no losses. Its the gain you make thats taxed not the amount of money you receive. Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022.

In 2022 those rates range from 10 to 37. Ron Wyden D-OR chairman of the Senate Finance Committee introduced legislation on Wednesday requiring taxpayers with more than 1 billion in assets or more than. You dont incur a tax liability until you sell your investment and realize the gain.

19 percent for the CIT and PIT taxpayers if the tax value of an asset is determined. Currently the tax code stipulates that unrealized capital gains arent taxable income. There will be a corresponding debtor relationship where the debtor to the creditor loan relationship is within the charge to UK corporation tax and is required to bring into.

And then there are tax rates. To understand how this worksand whether. Gains do not affect taxes until the investment is sold and a realized gain is recognized.

More than 5 trillion is held by. Talk of a tax on unrealized capital gains has surfaced again as politicians seek ways to squeeze as much out of the American people as they can to fund Joe Bidens tenure. However not all realized gains are taxed at the same rate.

Tax unrealized capital gains at death for unrealized gains above 1 million 2 million for joint filers plus current law capital gains exclusion of 250000500000 for primary residences. The tax rate shall amount to. The top 1 paid an average individual rate of 254 which is more than seven times the rate the bottom 50 paid according to the Tax Foundation.

With their latest tax proposal Democrats are going after an elusive target. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. To increase their effective tax rate.

If you hold an asset for more than one year before you sell for a. If an investment is held for longer than a year the profit is taxed at the capital. Unrealized gains are not generally taxed.

Under the proposed Billionaire. For example if you bought a painting for 5000 and sold it later for 25000 youve made a gain of 20000. In a nutshell its a 20 tax on the unrealized capital gains hang on to that thought of American households worth at least 100 million.

What this means is that someone who owns stock or property that increases in value does not. Billionaires and their growing piles of untaxed investment gains. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

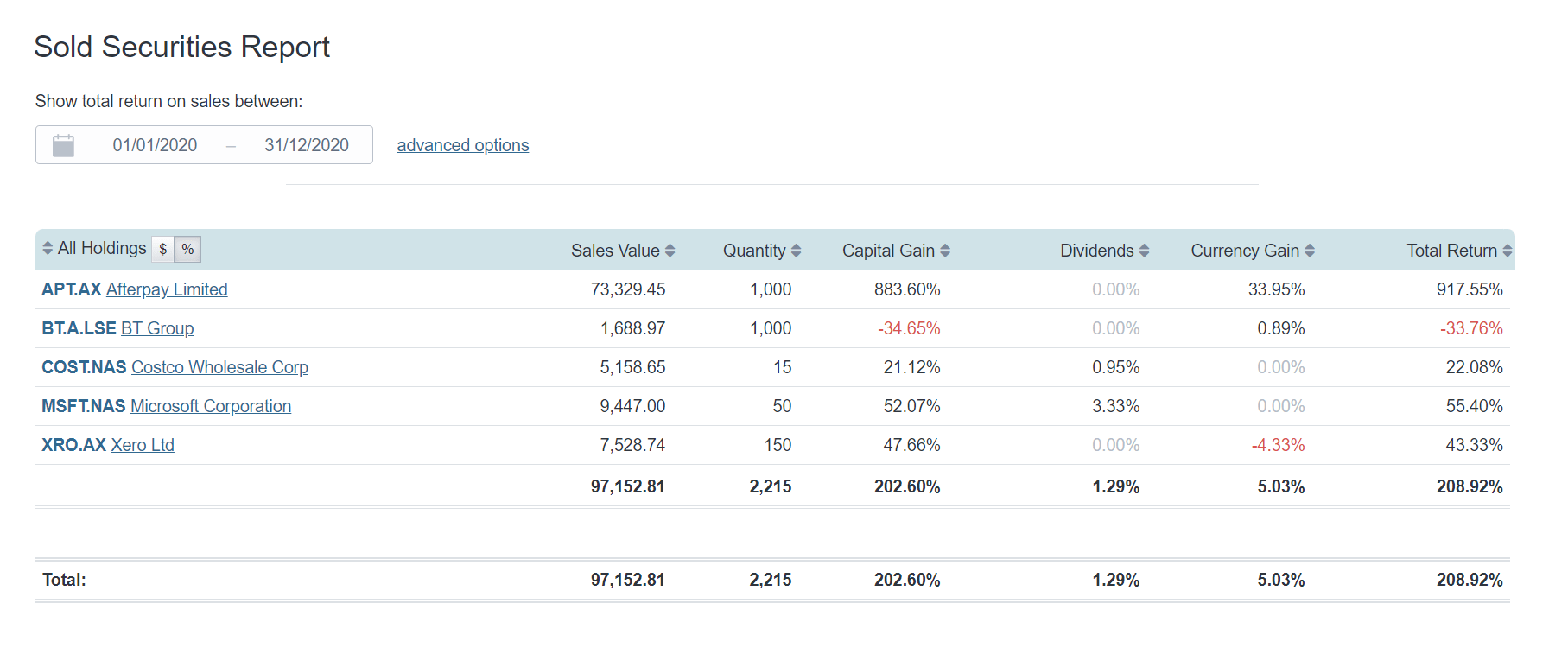

Investment Portfolio Tax Reporting Sharesight

Reporting Forex Gains And Losses For Corporation Tax Easy Digital Filing

How To Ease Your Crypto Tax Burden Nexo

Enjoy The Etf Tax Dodge While You Can

Reporting Forex Gains And Losses For Corporation Tax Easy Digital Filing

Annuity Taxation How Various Annuities Are Taxed

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

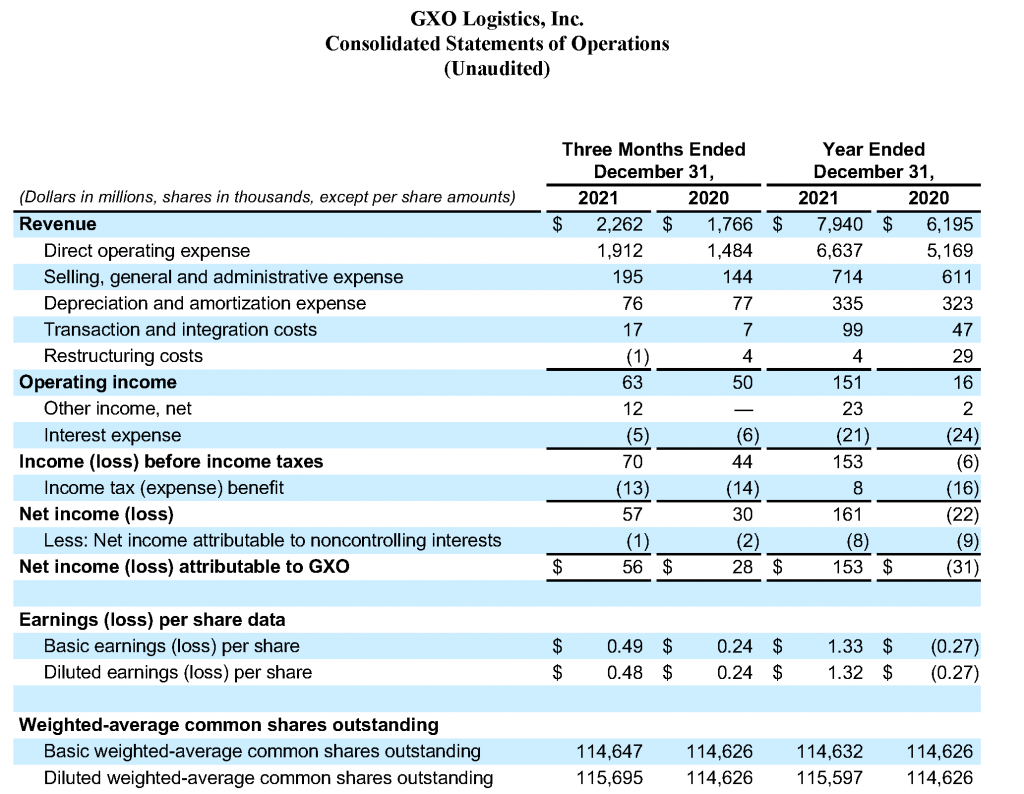

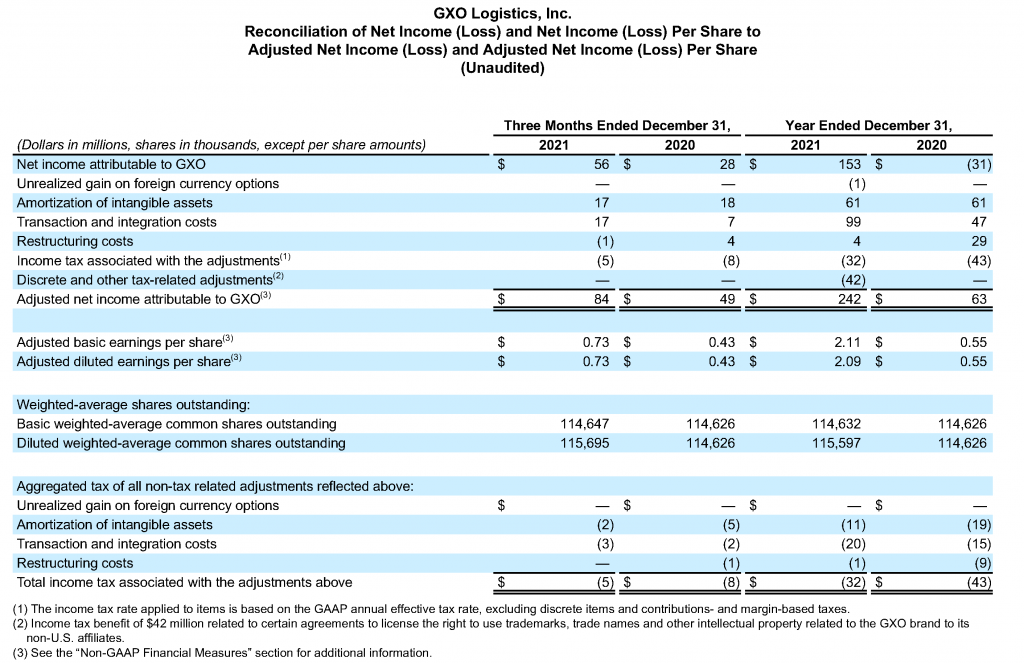

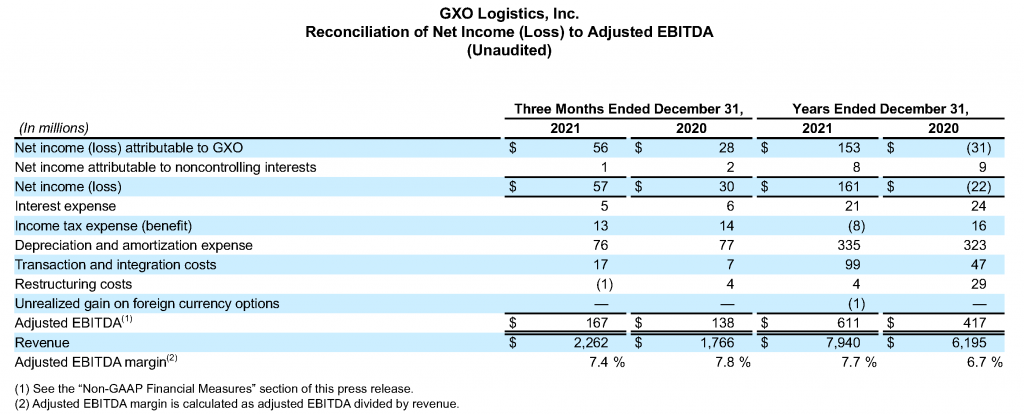

Gxo Logistics Reports Fourth Quarter And Full Year 2021 Results Gxo Supply Chain Management 3pl Contract Logistics

Capital Gains Tax Rates In Europe 2020 R Europe

Annuity Taxation How Various Annuities Are Taxed

Gxo Logistics Reports Fourth Quarter And Full Year 2021 Results Gxo Supply Chain Management 3pl Contract Logistics

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

Capital Gains Tax Rates In Europe 2020 R Europe

Gxo Logistics Reports Fourth Quarter And Full Year 2021 Results Gxo Supply Chain Management 3pl Contract Logistics

Reporting Forex Gains And Losses For Corporation Tax Easy Digital Filing